Our Vision and Mission

Why we do what we do

Carmen’s journey from a salesperson to running a sales training company began with one key realization: sales are always in demand. Whether business is slow or booming, sales are what keeps things moving. But the real turning point for her came from a personal experience that made her see how much potential everyone has – they just need a little guidance.

Back when she was a sales coordinator at Mandarin Oriental KL, she had a call with a client and kept saying things like, “My director said we can…” or “I’ll check with my director…” After the call, her director pulled her aside and gave her advice that stuck: “Next time, use your name. You’re the salesperson, not an order-taker.”

That feedback hit her hard because it made her recall another conversation. A client she had been working closely with asked, “Can I speak to your manager? It feels like you’re always getting answers from her, so maybe it’s faster if I just go to her.”

That was the wake-up call she needed. She realized she wasn’t showing clients that they could trust her to solve their problems. So, she asked her director for clarity on what decisions she could make on her own and started owning those client conversations. Instead of passing everything up the chain, she began saying things like, “I hear you. Let me discuss it internally and get back to you.” Clients stopped asking for her manager and started trusting her instead.

That experience taught her that with the right skills and mindset, anyone can sell. And sales happen everywhere – from recommending a restaurant to closing a million dollar deal. Not just in sales roles. That’s why she decided to be a sales trainer, with a simple mission: Help everyone sells better and feel good about selling.

Her career took off early—she became the youngest assistant sales manager at Shangri-La KL at just 24. By 26, she transitioned into sales training, and by 27, she was promoted to head of Learning & Development of Malaysia in J&T Express HQ. Today, she’s dedicated to helping others unlock their sales potential and achieve their own success stories.

Brands that train with us

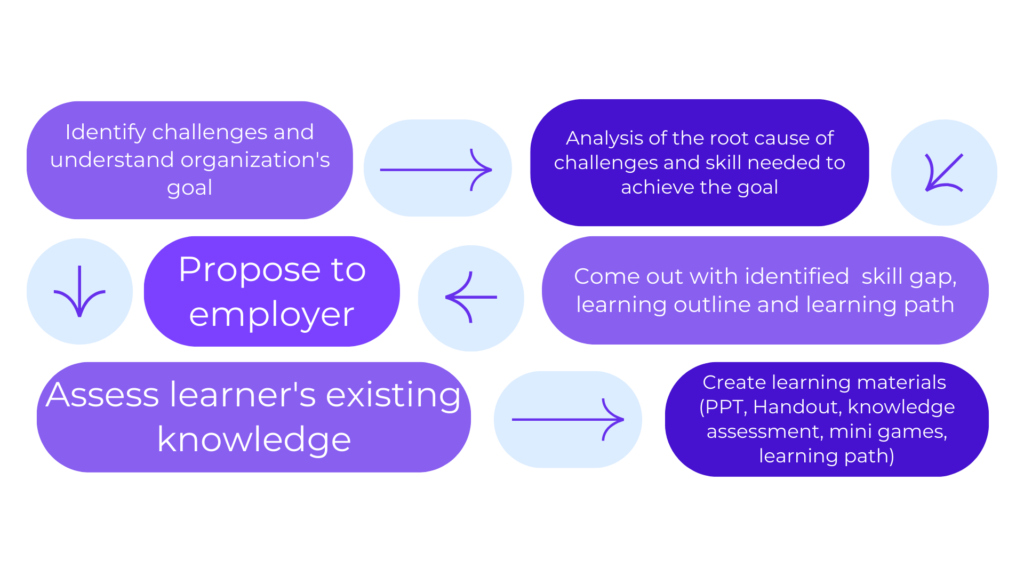

Our Seamless Enquiry Processing Explained Step-by-Step

Step 1: You will receive a reply within 2 hours

Experience prompt and responsive customer service, where we prioritise your needs and satisfaction, ensuring a response within 2 hours.

Step 2: Analyse the learning needs

Our dedicated team diligently sends you straightforward RFP questions to thoroughly examine every detail of your enquiry.

Step 3: Expert Evaluation

Our experienced team evaluates your enquiry with precision, utilising their knowledge and expertise to generate the best solutions tailored to your specific needs.

Step 4: Proposal Received!

You will receive a proposal within 1 day. If you need any extra help in comparing or presenting the proposal internally, just let us know!

Enhance Organizational Learning and Team Cohesion with HRDC claimable courses by Insighter Learning

Discover how INSIGHTER LEARNING’s HRDC claimable courses can boost your team’s performance through knowledge sharing and resource utilisation. Strengthen your organisational learning, foster team unity, and stimulate idea exchange with our tailored training programs. Collaborate with our experts to create a customised corporate learning solution that meets your staff’s specific needs. Empower your organisation’s growth and success with impactful training from INSIGHTER LEARNING.

Have question about course customisation?

Benefit of Customisation

Aligned with organisational goal

Ensures that the course content aligns perfectly with the specific needs and goals of the learners and organsation.

Increased ROI

Ensures that the training investment yields maximum returns by focusing on the specific knowledge and skills that will directly impact job performance.

Engaging and Motivating

Allows for the incorporation of real-life examples and case studies that enhance learner engagement and motivation.

Efficient Use of Time

By targeting the essential knowledge and skills, customised courses optimise the use of time, avoiding unnecessary content and focusing on what truly matters.

Frequently Asked Questions

HRDC claimable training refers to training programs or courses that are eligible for reimbursement or financial assistance from the Human Resources Development Corporation (HRDC). Employers can submit claims to HRDC for the expenses incurred in providing training to their employees.

HRDC provides resources, guidance, and funding opportunities to organisations for workforce development initiatives, helping them enhance the skills and capabilities of their employees.

You need to be a HRDC registered employer. If you’re not and wanted to become one, click this link https://hrdcorp.gov.my/registered-employers/ for more details

The function of HRDC (Human Resources Development Corporation) is to facilitate and promote the training and development of the Malaysian workforce. It aims to enhance the quality and competitiveness of the workforce by providing financial assistance, incentives, and support to employers for employee training and development activities.

Under HRDC, various training-related expenses are claimable, including but not limited to training course fees, examination fees, certification fees, training materials, and travel expenses directly related to training. However, it is important to note that specific guidelines and restrictions may apply, you may contact us for more up-to-date information.

Max RM8,000/group/day for HRD Corp Focus Area Courses and max RM6,000/group/day for Employer-Specific Courses. However, any training that is <5 pax will be prorated.

Apart from the legal requirement mandating registration for employers meeting sector criteria, enrolling with HRD Corp offers a myriad of support options for enhancing employees’ professional development and skills advancement initiatives.

Employer registration is mandated by the Pembangunan Sumber Manusia Berhad Act 2001 (PSMB Act 2001).

If your company employs ten (10) or more Malaysian employees, registration with the Human Resource Development Corporation (HRD Corp) is compulsory. For companies with five (5) to nine (9) Malaysian employees, registration with HRD Corp is optional.

Employers can submit their Form 1 online via the HRD Corp portal at www.hrdcorp.gov.my > Employers > Click Here for Registration.

HRD Corp is unable to verify eligibility via phone or email due to the need for validation of supporting documents and form information. Confirmation of eligibility can only occur once Form 1 has been processed by HRD Corp.

Failure to respond to HRD Corp within 30 days may result in employers being subject to a fine of up to RM2,000 as per Section 4A of the Act’s Regulations. Determination of employers’ eligibility under the Act is solely within HRD Corp’s jurisdiction and cannot be self-assessed by the employers. Employers are encouraged to complete Form 1 to obtain official confirmation of their eligibility from HRD Corp.

Registration process is free.

Companies registered with HRD Corp are required to remit a monthly Human Resource Development (HRD) levy, which amounts to 1% for the mandatory category (companies which has or more than 10 Malaysian employees) and 0.5% for the optional category (companies which has less than 10 Malaysian employees), calculated from the company’s monthly wages and fixed allowances.

Failure of payment before the stipulated time will result in;

Fine not exceeding RM20, 000.00 (Ringgit Malaysia Twenty Thousand) or imprisonment for a term not exceeding two (2) years or both (on conviction).

Yearly interest of 10 per cent in respect of each day of default or delay in payment.

Failure of payment before the stipulated time will result in;

Fine not exceeding RM20, 000.00 (Ringgit Malaysia Twenty Thousand) or imprisonment for a term not exceeding two (2) years or both (on conviction).

Yearly interest of 10 per cent in respect of each day of default or delay in payment.

No. Employers are not allowed to deduct from the employees’ wages under any circumstances for the payment of the levy.

An employer registration process takes up to 3 days if all required documents are correct and complete.

If the company director is paid a salary, he/she is regarded as an employee of the company, whereas a director who only accepts director fees is not considered an employee.

1) Company with 10 or more Malaysian employees: Levy= (Total wages or basic salaries + fixed allowances) x 1% [Basic salary is the unpaid salary of any payment]

2) Company with 5-9 Malaysian employees: Levy= (Total wages or basic salaries + fixed allowances) x 0.5% [Basic salary is the unpaid salary of any payment]